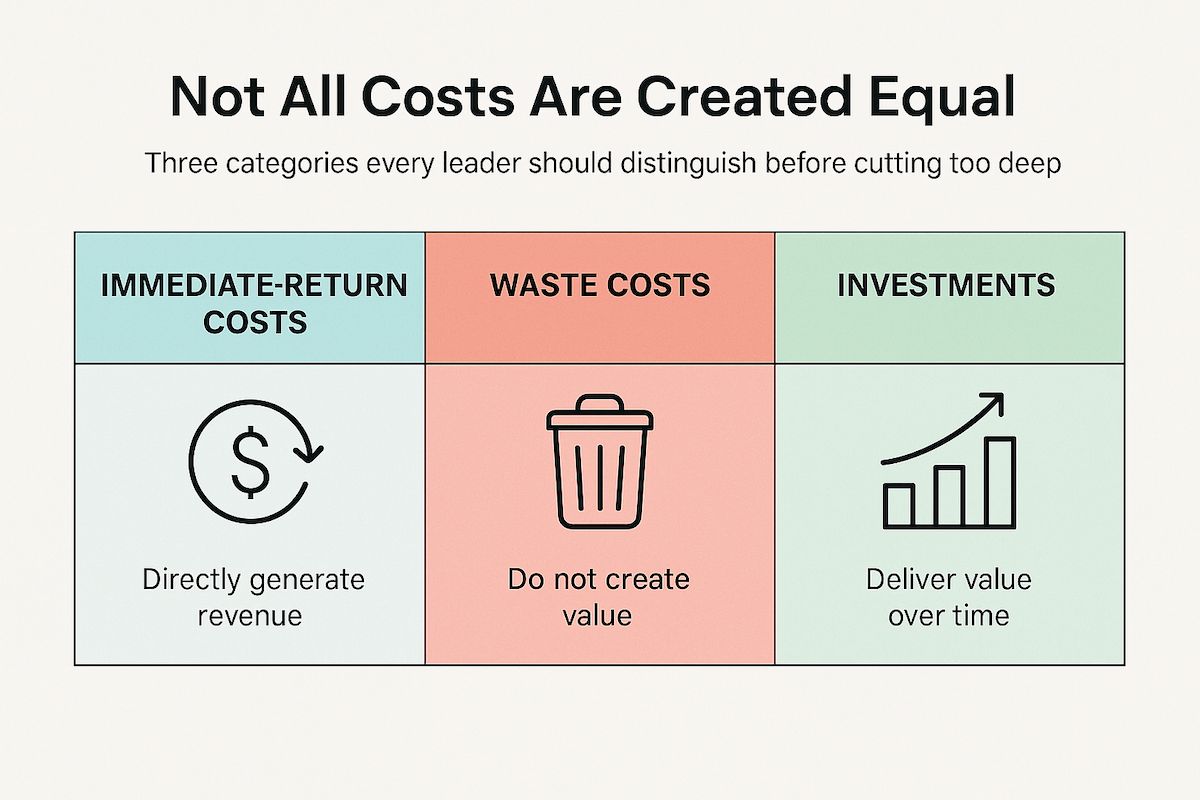

Three categories every leader should distinguish before cutting too deep

It’s budget season in many companies, when leaders review spreadsheets, debate line items, and make tough calls. This is when the difference between costs and investments truly comes into focus, decisions that define how wisely resources are allocated and asking the inevitable question: “What will this cost us?”

But not all costs are created equal. Some fuel today’s revenue. Some are pure waste. And some are genuine investments that secure tomorrow’s competitiveness. Knowing the difference, especially during budget season, when the pressure to cut runs high, is the key to smarter budgeting and stronger long-term performance.

This is why Klas Mellander, co-founder of Celemi and author of Apples & Oranges Everything you Need to Understand Business Finance, highlighted a subtle but critical accounting truth:

“An expense becomes a cost only when value leaves the company.”

Until then, money is still tied up in assets, materials, or capabilities. That insight is the foundation for distinguishing between costs that enable today’s results, those that erode value, and those that build the future.

Three categories to balance budget season costs vs investments

Instead of treating all spending as the same, leaders should separate costs into three categories:

- Immediate-return costs - money that leaves but directly generates today’s revenue.

- Waste costs - money that leaves without creating value.

- Investments - money transformed into capabilities or assets that deliver value over time.

On the surface, they all look the same: money flowing out of the company’s bank account. But their impact on performance is radically different. Treating them as one lump category leads to poor decisions, cutting investments while allowing waste to persist. These distinctions matter most during budget season costs vs investments discussions, when leaders must decide what to protect, what to reduce, and what to transform.

Category 1: Immediate-return costs

These are the fuel for today’s operations. They leave the company quickly, but in return they directly generate revenue.

- Raw materials turned into finished goods.

- Salaries for frontline staff delivering customer value.

- Packaging, shipping, or sales travel directly linked to deals.

The key is not to eliminate these costs, but to manage them efficiently. Without them, there is no revenue.

Category 2: Waste costs

These are the silent killers. Waste consumes resources but delivers little or no value in return.

- Rework from repeated errors.

- Unused software licenses.

- Duplicated processes or systems.

- Meetings that drain time without outcomes.

These costs look identical in the accounts to immediate-return costs, yet they erode competitiveness. Leaders who build financial acumen in their teams encourage employees to spot and eliminate waste relentlessly.

Category 3: Investments

Unlike waste or immediate-return costs, investments transform into something that stays in the company and creates value over time.

- New machinery or technology.

- Process redesign or automation.

- Training programs that improve capability.

- Product development that opens future markets.

Investments can be hard to defend in budget meetings because their return often lies years ahead. The paradox is that in accounting, their cost is spread over time (through depreciation or capitalization), but in reality, the cash often leaves upfront. This tension between “profit” on paper and “cash” in the bank is exactly where many leaders stumble.

A simple metaphor: The bakery

Imagine three spending decisions inside a bakery:

- Flour and butter - immediate-return costs. Essential to bake bread and generate today’s sales.

- Throwing away burnt loaves - waste. Money consumed with nothing to show for it.

- Buying a new oven - investment. A large upfront outflow of cash, but one that builds years of future capacity.

All three appear as expenses. But they are not equal. Only one drains competitiveness. One fuels today’s revenue. One builds tomorrow’s.

From metaphors to team life

In any team, these three categories are present:

- Immediate-return costs: Customer support salaries, marketing campaigns tied directly to sales, or IT services that keep systems running.

- Waste costs: Redundant reporting, recurring quality issues, or outdated tools that add no value.

- Investments: Digital training, leadership development, or system upgrades that enable future efficiency and growth.

Helping employees see these distinctions is a powerful step toward building business acumen. They begin to look at spending not only as money leaving, but as value being transformed, or lost.

The leadership opportunity: reframing budget conversations

Instead of asking only “What will this cost?”, leaders can ask:

- Is this a return cost we must manage efficiently?

- Is this waste that should be eliminated?

- Or is this an investment that will strengthen us over time?

This simple shift changes budget meetings from defensive cost-cutting to strategic prioritization. It empowers employees to advocate for investments with a clear business case, while also sharpening the focus on rooting out waste.

Practical steps include:

- Classify spending. Map key budget lines into return, waste, or investment.

- Ask about transformation. What does this spending become, a capability, a product, or nothing at all?

- Consider time horizon. Does value appear immediately or accumulate over years?

- Measure outcomes, not inputs. Judge training, systems, or process improvements by the performance gains they deliver.

For leaders who want to go deeper into evaluating spending decisions, Harvard Business School’s overview of cost-benefit analysis offers a clear explanation of how to weigh short-term costs against long-term benefits, a mindset that aligns closely with strategic budgeting.

Why this matters now

Budget season often brings pressure to cut costs across the board. The risk:

- Necessary immediate-return costs get starved.

- Waste continues unchecked because it’s hidden.

- Investments are cut because they look expensive in the short term.

The result is fragile performance today and weaker competitiveness tomorrow.

By using this three-part lens, leaders can cut smarter. Reduce waste. Protect the costs that fuel revenue. And make deliberate, future-oriented investments.

Closing thought

Not all costs are created equal. Some are fuel for today. Some are leaks to be sealed. And some are seeds for tomorrow.

As leaders, our role is to help teams see the difference, and to reframe the budget conversation from “What will this cost?” to “What will this become?”

When organizations learn to navigate budget season costs vs investments with clarity, budgeting shifts from a numbers exercise to a strategic conversation about growth and resilience.

And in our next article, we’ll explore why even when you classify costs correctly, there’s still another challenge: cash flow. Because while profit is an opinion shaped by accounting rules, cash flow is always a fact.

Ready to talk?

If this sparked ideas, or if you’d like to explore how your team can build financial acumen through Serious Fun, let’s connect.

Request your copy of Apples & Oranges: Everything You Need to Understand Business Finance

or

Start a conversation with us: https://celemi.com/contact

Let’s make business acumen everyone’s business!